How To Do Keyword Research For Mobile SEO

As promised last month, I’ll be sharing more information about how to do mobile SEO specifically and less about why to do mobile SEO. This month, I’m going to go through how to do mobile keyword research. First, though, a brief explanation of why to do mobile keyword research. Mobile Keyword Research Then & Now […]

As promised last month, I’ll be sharing more information about how to do mobile SEO specifically and less about why to do mobile SEO. This month, I’m going to go through how to do mobile keyword research. First, though, a brief explanation of why to do mobile keyword research.

Mobile Keyword Research Then & Now

One of the primary reasons for doing mobile keyword research is that you could be missing out on keywords that your audience uses on mobile that they don’t use on desktop (e.g., [keyword + “nearby”]).

There are some categories, such as restaurants, where upwards of 30% of the volume comes from mobile devices, and if you’re not taking that into account in your keyword research, you could be choosing the wrong target keywords for your intended audience.

If you still need to be convinced that you should do mobile-specific keyword research, please go here, here or here. For the rest of us, however, this is how to do mobile keyword research.

Mobile keyword research used to be a pain. When I wrote about it back in 2008, there were various emulators and autosuggest tools that could help you discover mobile-specific or mobile-centric keywords that your target audience used on mobile devices, but not the same kinds of keyword tools that existed for desktop search.

Today, there are good tools from Bing and Google specifically designed to help marketers cater to mobile searchers, which makes the process much easier and the data more accurate.

You may have your own process for doing mobile keyword research, but in order to advance the practice I’m sharing part of what we do here at Resolution Media. If there’s anything you do that helps, please mention in the comments, or do as Aleyda Solis did in a recent post and share your processes for mobile SEO. Together we can move the needle for this discipline and make it easier for all of us to reach mobile searchers.

Keep in mind these three steps aren’t mobile-specific, as they apply to desktop keyword research as well; but there are differences in tools, metrics, and process that makes mobile SEO keyword research unique.

1. Define Goals & Success Metrics

Keyword research can’t be done successfully without an endgame. If you don’t know your goals for these keywords, it’s not worth the time and effort to discover the keywords.

How are you going to use this keyword research? If your content is adaptive or your site is responsive then knowing mobile-specific keywords isn’t going to help you that much, as your content needs to be reusable and device-agnostic.

On the other hand, if you’re researching for a site that is designed specifically for mobile URLs, you have the opportunity to use different keywords and content on your mobile pages. Either way, knowing what keywords your audience uses overall can help you meet your goals.

For example, if your content is adaptive and you want to ensure that you are accounting for mobile searchers, you can sort a keyword list by total search volume and select your target keywords based on volume and how closely the intent of the keyword matches your business goal.

If your content is strictly mobile, you can sort by mobile volume and/or % of total mobile volume to find keywords that are popular on that platform and have intent that matches your business goal. Either way, you need to define what you want your natural search traffic from mobile search to do once it reaches your site: click, buy, view, download, convert offline, etc.

2. Keyword Discovery

Once this has been determined, you need to discover how mobile searchers find your site and how mobile searchers find your competitors and other sites like yours. Use the following tools to collect a list of keywords that you’ll then qualify in the third step.

Google Webmaster Tools

GWT can be used to discover how people are currently finding your site on mobile devices. If you’re not optimized for the most popular keywords, this information won’t help you discover it, but you can at least see where you’re ranking for search terms mobile searchers enter.

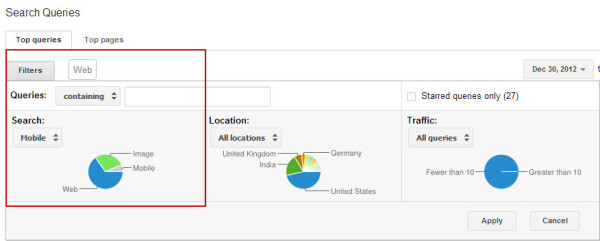

At the search queries report, filter search type by Mobile. This will give you just those keywords that come from mobile devices. Note that this report used to include information on both feature phone and smartphone keywords, but both have been combined into the Mobile category.

As such, these keywords are likely from smartphones, feature phones and tablets, although the interface doesn’t specifically say.

This report is especially useful because it allows you to see rankings, impressions, clicks and click-through -ate for mobile keywords, which can’t really be found anywhere else at the moment.

Google Analytics

To see mobile keywords in Google Analytics, go to Audience > Mobile > Overview in the right hand nav.

Now filter to exclude (not set) and (not provided) and include only mobile keywords.

This will give you keywords used by mobile and tablet users. If you want to separate tablet traffic, use the Mobile Devices report and the regular expression I mentioned here.

Google Keyword Tool

The Google Keyword Tool is the only mobile-only keyword tool that I’m aware of that gives you mobile-specific keywords that you’re not already optimized for if you enter a URL, category or keyword.

In the Google Keyword Tool, select all mobile devices in the Advanced Options and Filters, and you’ll get keywords from tablets, smartphones and feature phones. You also have the option to select only smartphones and tablets, or only feature phones.

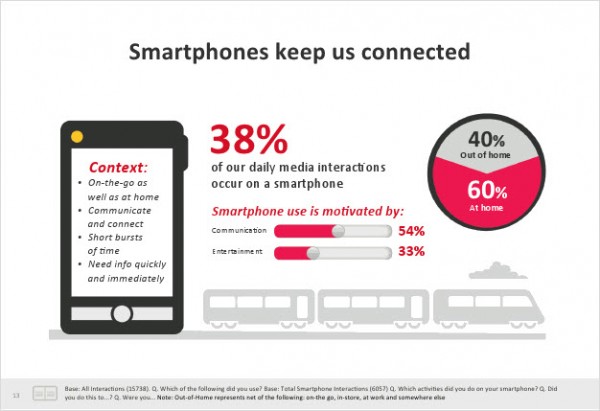

As with traditional keyword research, think about how a user might find your site, but don’t confine yourself to a desktop context. As I mentioned a few months ago, smartphone usage doesn’t necessarily imply a mobile context, as 60% of smartphone usage occurs at home. However, mobile does in some cases lead to new types of search behavior.

Ask yourself what that might be for what you’re promoting (e.g., apps, nearby, phone numbers, hours, etc.), and see if new types of keywords are relevant to your audience in a mobile context.

Bing Ads Intelligence

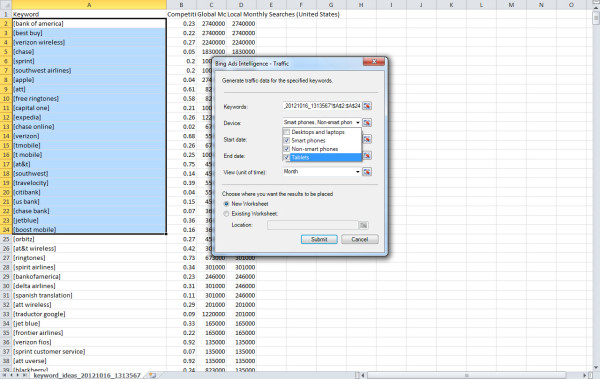

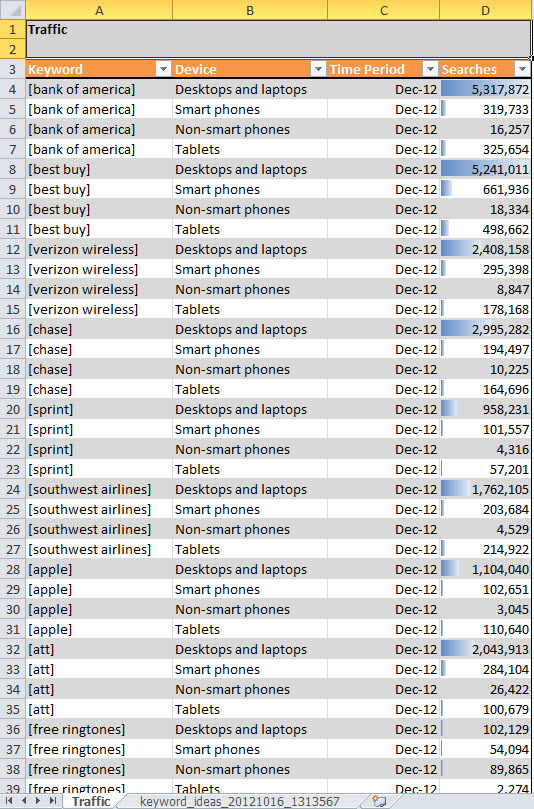

Bing Ads Intelligence can’t generate mobile keywords as the Google Keyword Tool can, but it’s the only tool that I know of that can estimate tablet search volume.

Take the list of mobile-specific keywords that you’ve compiled so far and run a customized traffic report in Bing Ad Intelligence, selecting Smart Phones, Non-smart phones (i.e. feature phones) and Tablets.

Ultimately, this gives you a list of keywords with monthly impression share in Bing for various platforms.

There are no match types in the BAI traffic tool, so although it’s tempting to use this data to get a more complete picture of total share of voice, it’s not recommended.

The data, however, can be used to ensure Google data is accurate, and to give a second look to keywords that appear with a lot of volume in Bing, but not in Google.

Finally, this data can be used to estimate tablet traffic in Google, which I’ll cover in a later column.

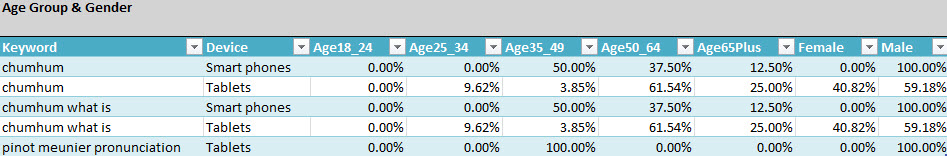

Bing Ads Intelligence also allows you to get demographic info on your mobile users, which can be helpful if you’re building personas and you want to compare mobile personas with desktop.

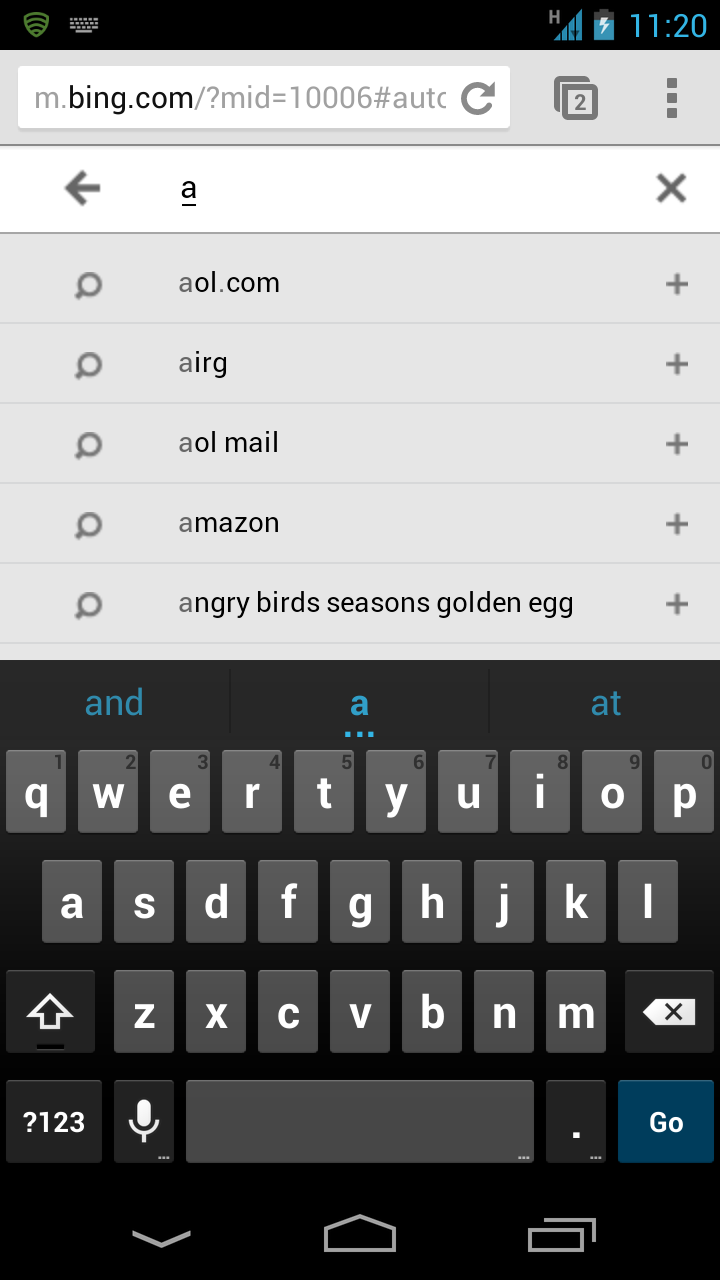

Bing Search Suggest

Unfortunately at present, Bing Ads Intelligence doesn’t give you a way to discover mobile keywords, per se, but you can do that by using Bing’s autocomplete feature in mobile.

Simply type a word or character that you’re researching, and mobile-specific keywords appear in the interface. I confirmed with Bing that these were mobile-specific keywords in 2011.

App Keyword Research Tools

Neither Google nor Apple have a keyword tool for Apps, so if you are doing app store optimization it’s a little more difficult to get what you’re looking for.

As I explained in my list of the most popular app store searches from last year, the best place to get official information on app keyword popularity seems to be the engines themselves, which offer app-specific keywords in the autosuggest for their search engines.

Autocomplete in Google Play gives popular app queries after three characters.

There are also paid tools available that help you get a better sense of popularity in a keyword tool format, such as MobileDevHQ.

MobileDevHQ’s keyword analysis tool is an unofficial keyword tool for mobile apps.

Keep in mind that the unofficial tools can only give you an approximation of search volume based on proprietary algorithms, so take it for what it’s worth. Until app store keyword tools are released, search suggest and these paid tools are all that’s available to help discover relevant keywords.

3. Keyword Qualification

At this point, you should have a lot of mobile keywords, but how do you decide what are the best ones? Volume can help you estimate traffic and competitiveness, but it’s not enough on its own. Here are a few exercises that we use to help us make better business decisions with mobile keywords.

Count of Queries by Platform

The Google Webmaster Tools mobile search queries report is good because it’s one of the few that allows you to compare your desktop queries with your mobile queries and discover differences in the search behavior of users accessing your site from different devices.

To do this, simply download your Mobile and Web CSVs by using the filter in the search query report and downloading the tables that appear.

Then, use Excel to label those queries that only appear for desktop searches, those queries that only appear for mobile searches, and those that appear for both.

You can then get a better understanding of what kind of site you need to create by examining the variance in search behavior in a simple pivot table chart like the one below.

Obviously, the data is stronger the more queries you have; but, if the great majority of queries appear in both desktop and mobile, adaptive content or responsive design is probably the way to go.

But, if the opposite is true and there are a majority of desktop-only and mobile-only keywords, then this could be an indication that your audience uses different terms on mobile than they do in desktop search engines, and you should probably optimize certain pages (if not the whole site) to accommodate your audience.

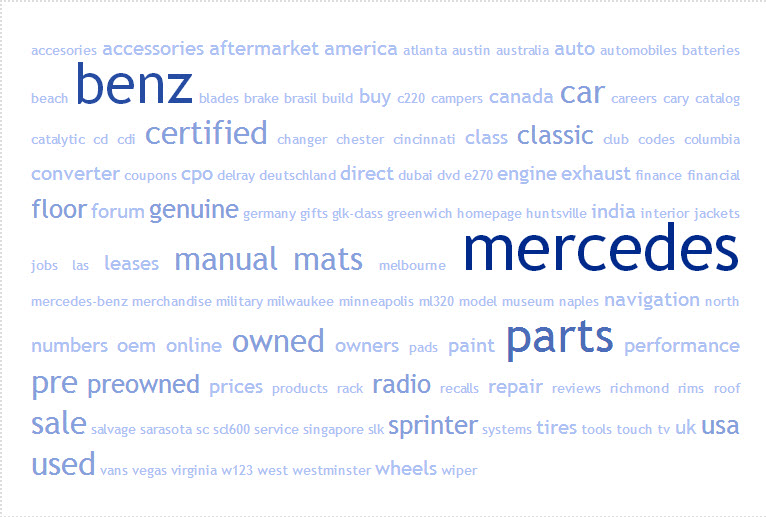

Mobile/Non-Mobile Tag Cloud

To get a quick look at the kinds of things your mobile audience is interested in, it’s helpful to use tag clouds of the long-tail.

To do this, simply copy your keyword list into a tag cloud generator like TagCrowd, for both desktop and mobile keyword lists.

Tag cloud of searches to Mercedes Benz site from desktop users.

Tag cloud of long tail searches to Mercedes site from mobile devices.

Often, this will show you at a glance, keywords that are used more by mobile users than desktop users overall. For example, in the tag clouds above, you can see that the mobile searchers are using more specific models than desktop searchers when looking for a Mercedes. They also appear to be looking more for dealers and locations than desktop searchers.

Mobile % of Total Traffic Report

This last method shouldn’t be a surprise to regular readers, as I’ve mentioned it in the past and in a recent mobile site audit on the Stone Temple blog.

Once you have all of your keywords, you need to use the Google Keyword Tool to estimate exact match search volume. This way, you have a better sense of the total volume for a given keyword in Google, and aren’t leaving out 30% or more of the search volume when deciding on qualified keywords.

But, this report is most helpful for the Mobile % of Total Traffic metric. This metric gives us a sense of what people are interested in on mobile devices vs. desktop.

For the Mobile % of Total Traffic column, use conditional formatting to make everything above 30% green, everything between 15 and 29% yellow, and everything below 14% red.

These numbers were used because on average last year, one in every seven searches in Google came from a mobile device, and some industries (like restaurants) had as much as 30% on average.

The idea is that anything above 30% represents greater opportunity than the industries with the most mobile search traffic and should be recognized as such.

With this list, we can sort it by total volume and optimize one site, whether that’s responsive or contains adaptive content.

We can also decide what types of things should be foregrounded on our mobile site by looking at those terms that have both a lot of search volume and a lot of search volume in mobile relative to the total. For example, we might not foreground content related to used Mercedes on the mobile site, as it’s not nearly as popular on that platform.

We can also categorize this list and get a better sense of what belongs on the site holistically. This way, we avoid variance in search volume by keyword and only focus on the category.

There are other methods that we use at Resolution, such as persona development, understanding basic query intent, etc. However, this guide should give you a better idea of the tools available to keyword researchers looking to understand mobile searchers, as well as specific techniques that can be used to find keywords and concepts that mobile searchers use that are relevant to the brand you represent.