Uber CEO: We Expect This Business To Be Very Profitable

“Not only do we expect to hit cashflow break-even, but we expect this business to be very profitable at maturity,” says Uber CEO Dara Khosrowshahi. “I think that going forward our spending declines as a percent of revenue. So when you’re growing trips 35 percent year on year your spending is going to increase. But we’re going to get leverage on the marketing line and we’re definitely going to get fixed cost leverage going forward.”

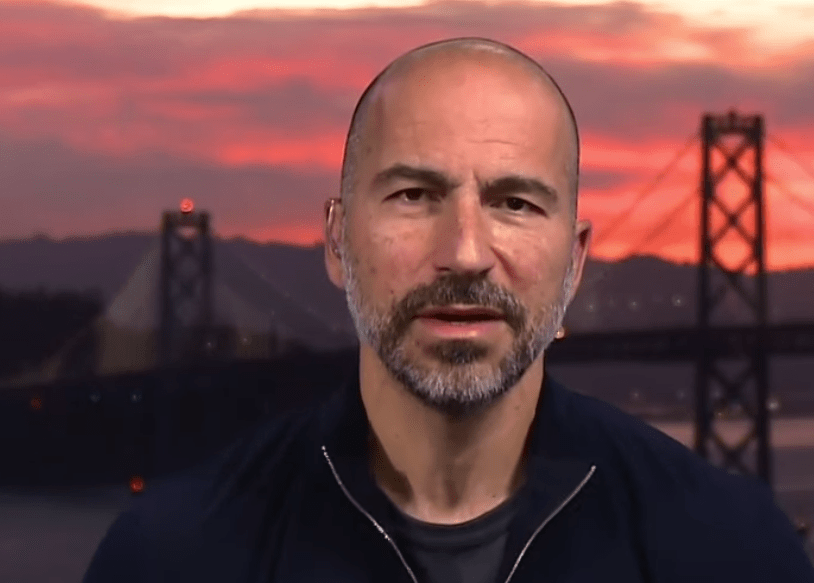

Dara Khosrowshahi, CEO of Uber, discusses the company’s latest quarterly results and predicts that Uber will ultimately be very profitable in an interview on CNBC:

Uber Is Much More Than a Rideshare Company Now

The IPO for us is a once in a lifetime moment. It was a really important moment for the company. Some of what we did like the driver appreciation award, almost $300 million that we put in the hands of over a million drivers globally were really important for us to do. It created a messy P&L from an accounting standpoint. I think it is hiding underlying trends that are actually very healthy for the company. If you look at trends for the company which is going to matter long-term, you have got gross bookings over $16 billion growing 37 percent on a year on year basis. You’ve got trip volume, and trips are units, growing 35 percent year on year. You’ve got audience, monthly active platform customers, now over 100 million, growing 30 percent. The actual revenue growth excluding the driver appreciation award was up 26 percent.

What I did tell our investors is to expect that to accelerate into the back half of the year. The back half of the year you are going to see if trends stay the same, revenue growth in excess of 30 percent. When you look at profitability, we beat our own internal targets and we beat Street targets as well. We came in at a loss of $656 million. It’s still a big loss but the losses are improving and the take rates are improving. If you back out some of those one-time expenses, we went from a loss of $800 million to a loss of $656 million. We got much more efficient on the marketing front. We actually took marketing as a percentage down while we were still growing the top line over 30 percent as well. This is much more than a rideshare company now, it’s a transportation company.

We Expect This Business To Be Very Profitable At Maturity

We are in a situation as far as the network effect of the company where we don’t need to increase the marketing and incentives. We can go in with loyalty plans both for riders and drivers that are going to add to leverage and ultimately profitability of the company. This is a marketplace company that has over 20 percent revenue margins and revenue margins are increasing year on year. Not only do we expect to hit cashflow break-even, but we expect this business to be very profitable at maturity.

I think that going forward our spending declines as a percent of revenue. So when you’re growing trips 35 percent year on year your spending is going to increase. But we’re going to get leverage on the marketing line and we’re definitely going to get fixed cost leverage going forward. I think that this quarter proved that out and we have to keep hitting our marks in the next couple of quarters. It’s a super-competitive marketplace but we are confident. We like what we saw operationally this quarter.