Decision trees for SEM segmentation

There is an ongoing debate amongst SEM experts as to how to best segment your PPC accounts, and columnist Aaron Levy illustrates his process with a handy flowchart.

One of the most common and difficult choices you’ll make when managing an SEM account is deciding when to segment keywords. Any search manager worth his or her salt knows that segmentation is key to PPC optimization, but what’s the best rule for how granular you should get?

There are a few different camps on this. There are the long-time advocates of Single Keyword Ad Groups (team SKAG), and even the occasional Single Keyword Campaign. Then, there’s the nearly decades-old “1,000 searches rule,” wherein if you expect a keyword to have more volume than 1,000 searches a month, it needs to be segmented, regardless of messaging. Some people (myself included) religiously believe that match types should be segmented by campaigns, while some simply smash everything together.

Regardless of keyword segmentation strategy, most managers rely heavily on a hybrid of bid portfolios and engine bid modifiers to take care of performance nuances for us. A little ironic, no? We were (and still are) collectively incensed that Enhanced Campaigns hampered ability to segment devices. “They’re taking away our control,” we screamed and blogged. Yet for some reason, we wholly embrace bid modifiers to take care of everything from audience to geo to behavior.

My issue with bid modifiers is simple: They don’t move budget, and they don’t change messaging. To do that, you need to segment intelligently to ensure you’re making the smartest decision with every dollar invested.

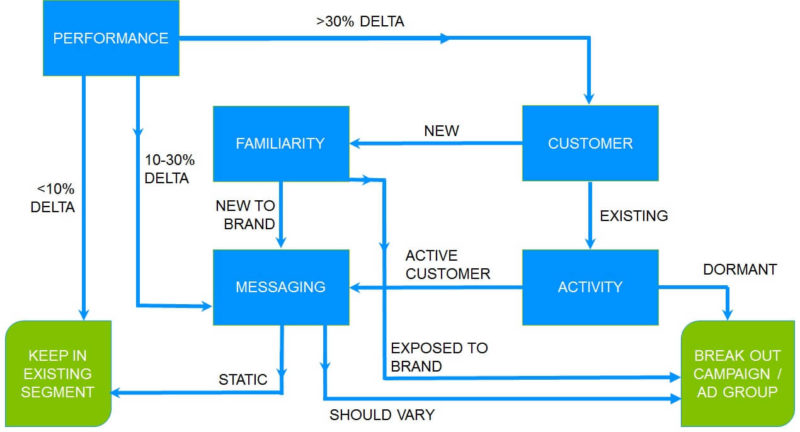

To help with the process, go through a decision tree with each keyword and customer segment. The tree below only has two major segmentation decisions you have to make: Is there a significant performance delta (Does it have a big enough difference to matter?), and should messaging be different?

A quick caveat before we get started: This decision tree is merely an example I’ve used to illustrate the thought process that goes into SEM segmentation. You should not structure every single account based solely on this tree. But, at the very least, it should get you thinking about how to best optimize your own account structure.

Performance path

Delegating budget based on performance is hands-down the most important decision you should be making when deciding how to segment an account. Our job is to squeeze every single solitary cent of revenue we can out of the money invested. As it stands now, most of us are hyper-focused on testing and tweaking every single possible modifier to ensure we’re bidding as efficiently as possible.

I recommend setting three performance thresholds to start your decision path. It’s up to you to set these thresholds; as a starting point, a >30 percent performance delta can start you down a customer segmentation path, a 10 percent to 30 percent delta can send you down the message segmentation path and a <10 percent delta can be kept “as is.”

If an account is brand-new, head straight for the messaging path. Just leave room to chop up later as data accrues.

Customer path

Is the searcher an existing customer or a new customer?

We can discern between existing and new customers fairly easily, thanks to our dear friends, “Customer Match” and “Remarketing.” Set up both a Remarketing list for converters and a recurring Customer Match upload to creative customer audiences, and segment them out into defined existing customer campaigns. Once you start collecting data, you can identify the differences between the two behaviors and segment accordingly.

If a new customer, proceed to the “Familiarity” section of the Customer path. If an existing customer, proceed to the “Activity” section of the Customer path.

Is the potential new customer familiar with your brand?

Brand awareness can play a huge part in paid search performance. It can rear its head in a variety of ways. Sometimes, you might see a regional uptick in brand awareness based on where other advertising is strong or competition is weak. In other cases, it can be dependent on the individual customer’s viewpoints. I’ve seen CTR vary by upwards of 400 percent (with an associated 800 percent lift in ROAS) where brand awareness is high.

If a new customer has been exposed to the brand, segment them into their own campaign. The simplest way to do this is via RLSA (where you can often afford to bid more), but regional segments can isolate performance as well. If a new customer is unfamiliar, proceed to the Messaging path (below).

Has the existing customer lapsed to a point of no return, or are they active?

Every potential buyer likely has some version of brand affinity, showing commitment bias to one brand or another. Depending on your own customer life cycle, there is likely a point when, if a customer is lapsed for too long, their affinity and likelihood of ever returning dwindles down to nothing. This can vary from years (for high-ticket items like a house, a car or a high-end B2B software purchase) to months (for seasonal turnover items like shoes or clothing) to weeks (for impulse purchases like entertainment or small tchotchkes).

If your customer falls into the “Active” segment, they’re more likely to be a repeat purchaser and still share some of that same brand affinity, and you can safely proceed to the Messaging path. You’ll have to treat your dormant customers the same way as you would treat those who are new to your brand. Segment them either at the ad group level or campaign level (your call based on performance), and offer them something new to get them to return.

Messaging path

Does messaging need to vary between the keywords or audiences?

If the answer is yes, segment. If the answer is no, don’t.

Where it gets a little complicated is when you do decide to create a new messaging segment. At the time of this publication, there’s no silky-smooth way to customize copy based on a geographic region for any major search platform; while there are scripts to run within AdWords to customize copy by region, they’re clunky and not particularly effective if you have a large number of different city names. There are tricks in Bing Ads using param functionality, but again, they’re clunky at best.

Instead, the burden falls on the advertiser to make the decision whether to segment a campaign out by region just to vary messaging or not. This is an experiment that can get out of hand quickly; in my experience, there’s usually a click-through rate increase of about 25 percent for regionally specific copy when done well.

The test can get out of hand in a hurry, however; there are 100+ major metropolitan areas in the US alone. Does that mean we should clone our campaigns 100 times over? Of course not. Probably not. Maybe not? Which brings us to our final topic…

Decision thresholds

When you’re looking at 120+ possible audience segments for each term, things can get out of hand quickly. While the decision tree is not designed to make a campaign manager’s life miserable, but that can happen if applied too strictly.

The reason for hyper-segmentation is to maximize the efficiency of every dollar spent. To maximize efficiency and make smart bidding decisions inherently requires a certain level of data, even for the most sophisticated of tools.

There’s no golden rule here — no silver-bullet segmentation threshold. Instead, think about the quantity of data that would be needed to make a sound bidding decision based on a given industry. A safe rule of thumb is to use Google’s threshold for active bidding tools — around 15 conversions in 30 days should be significant enough for a segment to be broken out. Any smaller than that, and you’ll only be doing damage.

Too much extra work?

Not a chance! The most common objection to this strategy is that, by moving keywords around or cloning them into separate campaigns/ad groups, you’ll wind up with a ton of duplicated effort and extra work. On the contrary, I ran the data on myself using Toggl (my time-tracking tool of choice) and found that I spent ~20 percent less time managing the day-to-day on an account after hyper-segmentation than before — with stronger performance to boot.