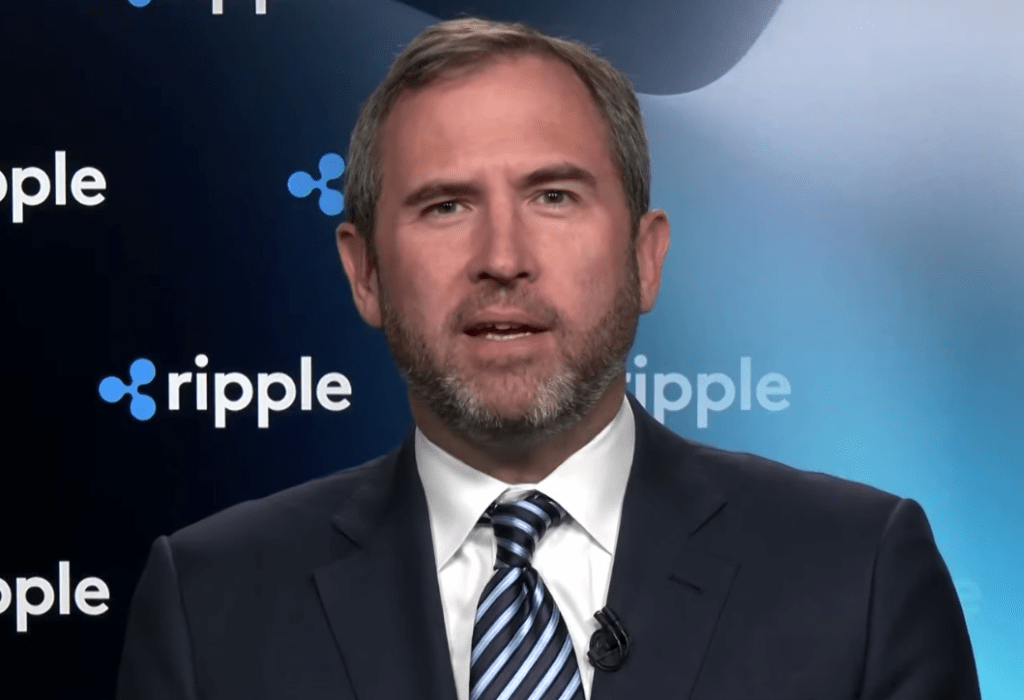

Incredibly Positive For Blockchain Market to Have Facebook Leaning In, Says Ripple CEO

“It’s an incredibly positive signal for the overall blockchain and crypto market to have a player like Facebook leaning in,” says Ripple CEO Brad Garlinghouse. “There’s been obviously a lot of skepticism in the origins of crypto coming from kind of an anti-government and anti-bank point of view. To see major industry players lean in and participate in marketing is really positive for the overall market. What I’ve heard is the technology isn’t quite ready to go live but sometime in 2020 they’ll be out there actually deploying that.”

Brad Garlinghouse, CEO of Ripple, discusses their investment and partnership with Moneygram and the impact on the blockchain and crypto market on the eve of Facebook’s entry into cryptocurrency in an interview on Bloomberg Technology:

Incredibly Positive For the Blockchain and Crypto Market to Have Facebook Leaning In

It’s an incredibly positive signal for the overall blockchain and crypto market to have a player like Facebook leaning in. There’s been obviously a lot of skepticism in the origins of crypto coming from kind of an anti-government and anti-bank point of view. To see major industry players lean in and participate in marketing is really positive for the overall market. It’ll be really interesting to see what part of the market they focus on. David Marcus has been an incredible leader and given his experience at PayPal I expect we’ll see them do something very consumer-oriented part of the payment system.

I’ll be watching alongside everyone else to see what they decide to pursue. What I’ve heard is the technology isn’t quite ready to go live but sometime in 2020 they’ll be out there actually deploying that. For me, what money Graham and the stuff we’re doing today is the key difference. It’s what can we do today with these technologies to solve real problems? It’s been really hard for the people following this industry to separate what is noise and what is actually real and pragmatic today.

I don’t think (anything Facebook does will make Ripple less relevant). Facebook is obviously a company with Instagram and Whatsapp. What Ripple is doing is really enterprise infrastructure and interconnecting various payment networks around the world. We’re working with some of the biggest banks around the world, small payment providers, and really providing that interoperability between the different networks as opposed to solving within a network kind of problem. It’s just very very different than what I expect Facebook is going to be doing.

Ripple Investing In and Partnering with MoneyGram

The deal (with Ripple investing in and partnering with MoneyGram) is a big step for Ripple but it’s even a bigger step for the overall industry. There’s been a lot of excitement around what blockchain and what digital assets and crypto can mean for the industry. I think it’s the reason why players like Facebook are diving in also. But we haven’t yet seen much beyond experimentation. Really at Ripple, we are the market leader because we have matured aggressively and we’re really solving real problems for real customers. MoneyGram is just the manifestation of that. As the second largest global remittance company we are able to have a big impact with one customer and one partner in this.

What Western Union said, and they’ve been around for decades, what they said is that in our beta time, the time where the product hadn’t yet launched, they said that we matched the efficiency of what they were already optimized. My view on that was they had spent decades getting to an efficiency that we matched with a beta product. I was actually really pleased that Western Union could come out and say we’re already as good as their (current product) considering the other decades they had invested in building out that capability.

MoneyGram Is An Undervalued and Strategic Asset in the Payments Landscape

With MoneyGram we know out of the gates we can actually make their system much more efficient. The key reason is today both Western Union and MoneyGram pre-fund accounts around the world so they can make payments. MoneyGram and Western Union have negative working capital. What our products allow those companies to do is to not pre-fund and to shoot payments in real-time. That’s a massive savings in terms of the efficiency, not just in terms of what is the cost in FX, but the capital cost, and the outlays. That’s really a dormant asset when you pre-fund those just sitting there waiting for people to make payments. That’s really the transformational thing that XRP as an extremely efficient digital asset allows for the industry.

What we committed to do is to invest up to $50 million. We will end up owning somewhere between about 6 or 7 percent and 10 percent of the company. They decide over the course of the next year how much of that $50 million they want to call down. At close, they’ve called down $30 million at a price of $4.10 per share. We’re excited to be shareholders because we think that actually it’s been an undervalued asset. As you may know Ant Financial tried to buy MoneyGram over a year ago. That was ultimately blocked by CFIUS (Committee on Foreign Investment in the United States). We think it’s a really undervalued and strategic asset in the overall payments landscape. We couldn’t be more excited to have a shared vision of how digital assets can change the nature of how liquidity is managed for payment providers globally.

What’s next for us is to continue to build out and expand the number of corridors where we’re live today. We work with over 200 banks and financial institutions around the world today. With this new product around liquidity, we’re now enabling liquidity into the Mexican peso and the Philippine peso. We certainly expect to be much broader than that but we’ve only been live with this product for about six or seven months. I feel like we’ve made tremendous progress in a short amount of time. We’re going to continue to invest with the customers we have today as well as expand the number corridors we support globally.