8 Benefits of filing ITR, even when income is below exemption limit

There are many investors who have very low or zero tax liability and therefore they skip filing their income tax return. Then, there are investors who do not file their returns for years and only when something urgent comes up which requires their last few years of ITR, they go to a CA and file their old tax returns.

Today, I will share with you why you should file your income tax return, even if you have income below taxable limit.

Before that, let me share with you what exactly is ITR, for those who are not aware about it.

What is Income Tax Return (ITR) and who should file it?

An Income Tax Return is a form, where a taxpayer discloses details of his/her income, claims applicable deductions and exemptions and taxes that are payable on the taxable income.

As a responsible citizen of India, everyone who has an income should file an ITR, because in this way we are actually declaring all source of income whether taxable or non-taxable.

The Income Tax Department mandates everyone to file income tax return, if one’s gross total income (before allowing deductions under section 80C to 80U) exceeds Rs. 250,000 in a financial year.

One can also file it even their income is below taxable limit or its zero (in which case it’s called NIL return). Filing Nil return will act as proof of accumulated funds in your bank accounts or other investments.

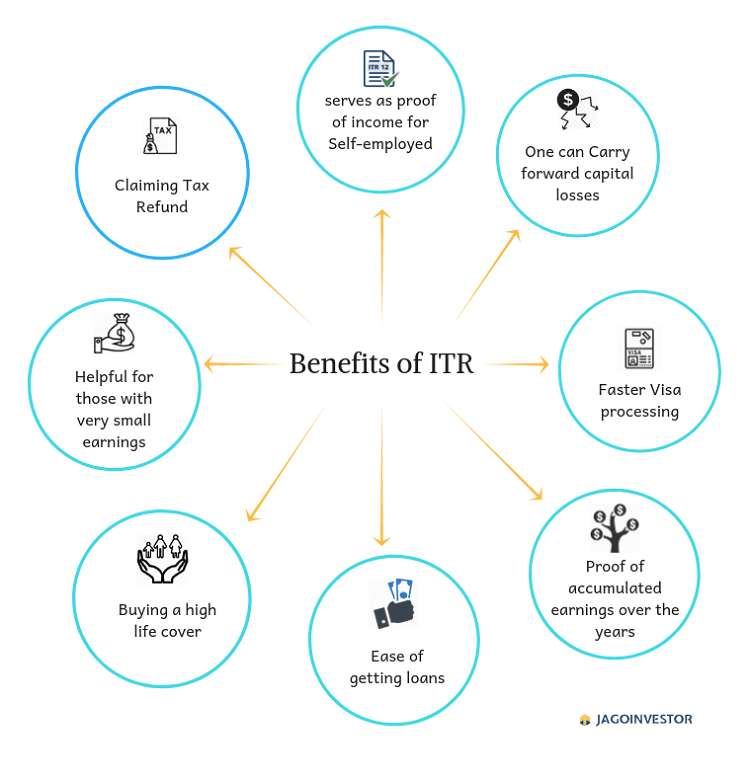

There are various benefits if one files ITR irrespective of their income. Below I have listed few benefits of filing ITR.

Benefit #1 – Proof of accumulated earnings over the years

It might happen that a person is earning some small income over the years which are below the taxable limit and over the years they accumulate good corpus. Now it may happen that they might get a tax scrutiny for some reason after few years.

If someone has not filed the ITR over the years, it will be a lengthy and tiresome process to explain the sources of earnings over the years. However with ITR, it will be a legal proof of income earned in each year.

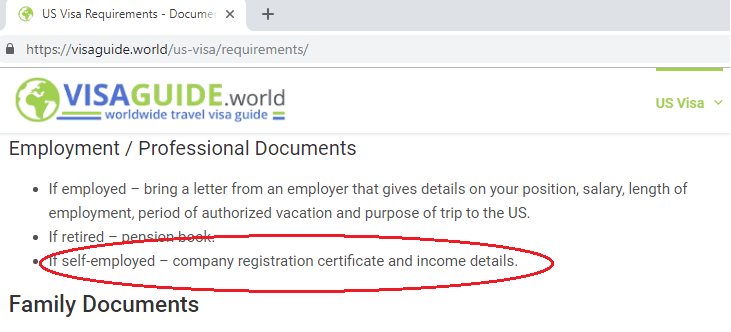

Benefit #2 – VISA processing

If you are traveling overseas or planning to travel in the near future, proof of earning is required. If you are salaried than employer certificate will work but if you are self-employed than income details are needed to be submitted. So, ITR return will work as income earning proof.

Benefit #3 – ITR serves as proof of income for Self-employed

Being self-employed does not provide earning proofs such as salary certificate from the employer and form 16. So, having ITR ready with you as proof of income is the most convenient proof.

Benefit #4 – One can Carry forward capital losses

If you have incurred capital losses, the Income Tax Act allows you to carry forward losses for eight consecutive years, and balance it against future gains and income.

To keep a track of your losses, the Income Tax Department has laid out that, Losses for a year cannot be carried forward unless that year’s return has been filed before the due date. So, even if it’s a loss return, you do not have any income to show – do file your return before the due date to declare the capital loss incurred.

Benefit #5 – Helpful for those with very small earnings

There are many people who get some small incomes such as

- Interest on bank/company deposits

- Dividends

- Family pension (received by legal heir)

- Tax free incomes like Agricultural Income , tax free bonds etc.

These people total income might be below the taxable limit and they might feel that they are not supposed to file any tax returns, as they don’t have to pay any tax (because TDS is already deducted). But by filing ITR they will get a legal proof of income (in case they need it).

Benefit #6 – Claiming Tax Refund

If you have paid excess tax on your income, then you can file for a refund from the income tax department. In order to get this refund, it is mandatory that you file ITR.

Getting a refund of your taxes feels like getting a paycheck credited. Many salaried people don’t file their ITR as they feel that the tax on their income has already been deducted and they have form 16. But, it might happen that, the employer has paid more tax on your behalf, not taking in consideration your actual house rent, tax saving investments or insurances. So, in that case filing of ITR will lead you to ask for refund from IT department.

Benefit #7 – Ease of getting loans

If you apply for any loans such as a home loan, car loan etc., then ITR for last 2-3 yrs is asked as the mandatory documents. ITR will help your lender to assess your repayment capacity and is an important document. A lot of people who have not filed ITR on time, rush at the last minute for these documents, so why not better file it on time?

Benefit #8 – Buying a high life cover

When you buy higher life insurance cover the Insurance company asks for proof of income to assess the cover amount to be provided to you. For this salary slip, bank statements or ITR of last 3 consecutive assessment years are required.

It might happen that you don’t get salary receipt or your monthly income is being paid from different groups so bank statement will also not work as strong proof. So, better to have ITR return filed.

Do you know someone who should file ITR in your circle/family?

I hope the above points will make you understand why it is always preferable to file ITR, even if it might be NIL return. In a lot of families, there are people on whose name there are small incomes like dividend income, income from tuition fees, small business income and this article applies.

So make sure you start filing an ITR for them and save yourselves from the future hassles involved.

Do share your views, experiences and ask queries through comments.