Search ad costs rise, conversion rates decline again in 2024

Search ad benchmark report finds advertisers are paying more for leads and clicks, while Google continues to report record profits.

Advertisers are paying more for leads and clicks, while Alphabet, Google’s parent company, keeps reporting record profits. While LocalIQ said this is due to “increased competition and intensified monetization of the Google SERPs,” it’s hard not to wonder what “levers” Google potentially may be “tuning” behind the scenes as Google keeps finding ways to justify higher prices despite not delivering equally greater returns for bigger investments from advertisers.

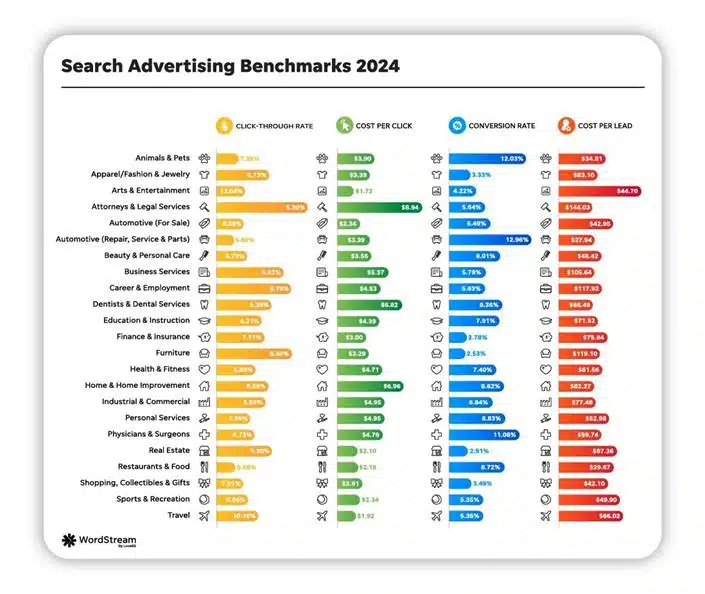

Conversion rate: 6.96%. Conversion rates increased in 12 out of 23 industries examined by LocalIQ.

- Industries with big decreases were Finance & Insurance (down 32.40%) and Dentists & Dental Services (down 19.57%). Industries with significant increases were Apparel / Fashion & Jewelry (up 112.01%) and Career & Employment (up 80.97%).

- The average conversion rate was 7.04% in 2023 and 7.85% in 2022.

CPL: $66.69. CPL increased by 25%, on average, in 19 of 23 industries. However, this is a slightly lower year-on-year increase than last year (27%).

- The average CPL was $53.52 in 2023 and $44.70 in 2022.

CTR: 6.42%. CTR increased by 5%, on average, for 70% of industries.

- The average CTR was 6.11% in 2023 and 5.91% in 2022.

CPC: $4.66. CPC increased by 10%, on average, in 86% of industries.

- The Real Estate, Sports & Recreation, and Personal Services industries saw increases of over 25% year-over-year.

- CPCs increased for 60% of industries, but only by 2%, on average.

- The average CPC was $4.22 in 2023 and $4.01 in 2022.

2024 search advertising benchmarks. Here’s the data, broken down by category (Note: a higher resolution image is coming):