Amazon uses its data to undermine third party sellers, EU antitrust action says

The company could face penalties of up to 10% of its total revenue, which was more than $280B in 2019.

Predatory data and pricing behavior. The EC argues in its Statement of Objections, a formal antitrust charging document made public Tuesday, that Amazon captures data from sales of third-party products on the site and then uses that data to “calibrate Amazon’s retail offers and strategic business decisions to the detriment of the other marketplace sellers.”

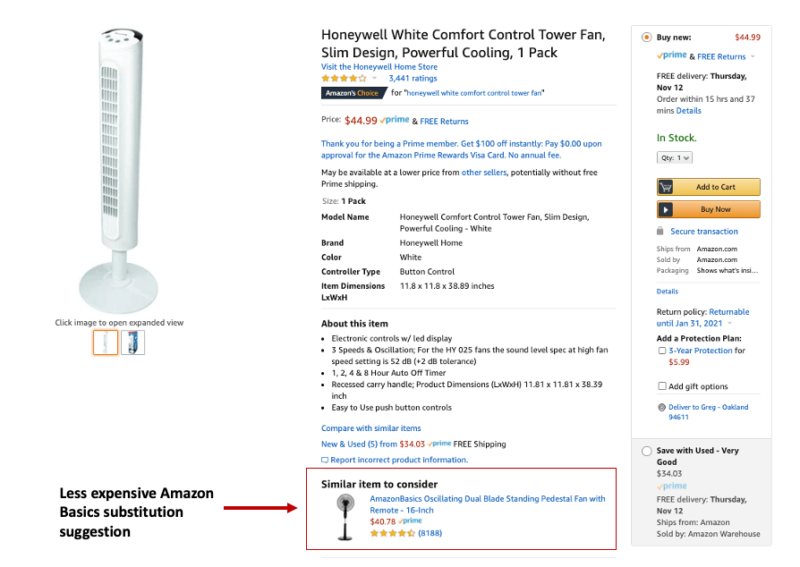

In essence, the charge argues, Amazon watches what products do well on its platform, creates its own version of those products (e.g. under its own Amazon Basics brand), prices them aggressively and offers them preferential visibility to undermine sales of the original, third party versions.

Amazon Basics substitution suggestion

A second, parallel investigation involves the Amazon “Buy Box.” The Buy Box is where the “ad to cart” and “buy now” buttons. As any seller knows, “winning the Buy Box” is critical to succeeding on Amazon. The EC is seeking to determine whether Amazon “might artificially favor its own retail offers and offers of marketplace sellers that use Amazon’s logistics and delivery services.”

Similar Congressional findings in U.S. Regarding use of non-public data and giving preferential treatment to its own products, the U.S. House Judiciary Subcommittee on Antitrust made a similar finding it its report, issued in early October. There the committee asserted that Amazon was “favor[ing] its own first-party products over those sold by third-party sellers.”

The alleged use of non-public third-party seller data allows Amazon, according to the EC, “to avoid the normal risks of retail competition” in France and Germany in particular.

Of course Amazon disputes the charges and says that it controls “less than 1%” of the global retail market. There’s some disagreement about Amazon’s share of online retail in the U.S. Emarketer has projected that Amazon’s share will be 39% this year, while another analysis puts the company’s share at a much lower 23% in Q3.

Aggressive new laws coming to curb big tech. In addition to these antitrust cases, the EC is also poised to introduce new laws that would much more aggressively regulate big technology companies in an effort to limit their unilateral market power. These new rules would, among other things, prevent self-preferential treatment and compel the largest technology companies to share data with competitors. The implications are sweeping.

With its aggressive antitrust enforcement, privacy rules (GDPR) and forthcoming stricter technology laws, the EU has become the world’s de-facto technology regulator. The new laws include rules prohibiting the self-preferencing of products and requiring the biggest companies to share data with smaller rivals.

Why we care. This is a different kind of antitrust case, because it focuses on the allegedly improper use of data to maintain market position and undermine competition. To a lesser degree, the existence of the EU case may embolden the U.S. Justice Department and FTC to bring a similar case against Amazon in the U.S.

Final resolution of the case could take years with appeals. However, assuming that the EC concludes Amazon is found to have violated the law, it could impose massive fines. The EC would also potentially force the company to change business practices in the near term — before appeals are concluded. That would likely include sharing data with third party sellers on the platform.