E-commerce ad spend on search and social product ads keeps growing

Product ad spend growth on social outpaced search in the third quarter, Kenshoo reports.

E-commerce advertisers spent 39% of their search budgets on Shopping campaigns and 37% of their social budgets on product ads in the third quarter of the year, according to new Kenshoo data.

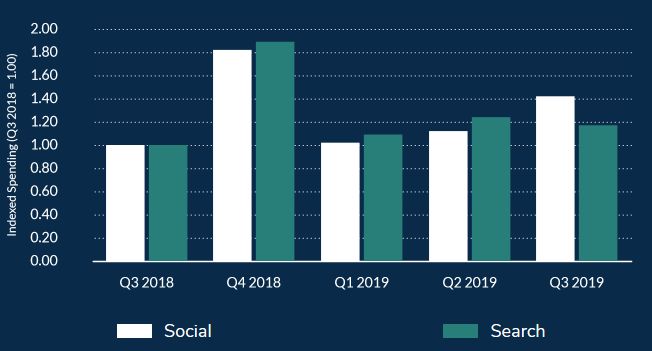

Social outpacing search. Spending on social product ads among Kenshoo e-commerce advertisers accelerated in the third quarter, increasing 42% compared to the previous year. Meanwhile, product ad spend on search grew by 17% year-over-year in the third quarter – a deceleration from the previous quarter.

The relative slow in Shopping campaign spend meant it had less overall impact on search spend, which grew 7% year-over-year and just 2% from the second quarter of 2019. Paid social spend increased by 32% year-over-year, driven by Instagram, video and product ads.

Why we should care. E-commerce advertisers continue to increase spending on Shopping and product campaigns, and that growth is set to continue in the fiercely competitive fourth quarter. This holiday season will also put the new Google Shopping experience in the U.S. to the test.

Kenshoo Senior Director of Marketing Research Chris Costello said that the Prime Day-related promotions in July “drove overall spending for the month to levels just shy of last November, which sets the table for another new high going into the holidays.”

The report reflects data from around 3,000 advertiser and agency accounts spanning 150 countries and encompassing campaigns run through Kenshoo’s platform on Google, Amazon Advertising, Baidu, Yandex, Yahoo, Yahoo Japan, Pinterest, Snapchat, Facebook, Instagram and Facebook Audience Network.